take-aways

-

These are four of the primary rules and advisory limits of creative real estate investing. These have been passed down from one established investor to another with the goal of keeping aspiring investors from crashing and burning.

- When investing creatively, you need to find even better deals than those who invest normally. Let me explain what I mean. Let’s say a certain home is worth $100,000. A traditional investor might pay $100,000 for that home, put a 30% down payment ($30,000) on the property, and make a nice return on investment from the cash flow (the extra money left after all the expenses are paid).However, if I were to purchase that same house for $60,000 because I took the extra steps necessary to get a great deal, which of us is in the better position? The traditional investor, who has $30,000 of their cash tied up in their property and no real equity, or me, who has nothing invested but owes less?Because of the deal I obtained, I have far greater potential for profit and for a better return on investment than the normal investor, but less of my cash is at risk because I have no cash invested at all.However, what if I decided to be just a “normal” investor and pay full price for that $100,000 property, with no money down? Most likely, my mortgage payment would be so high that good cash flow would be out of reach, and I would not have the equity necessary to be able to sell the property. In this case, the “good” investor would be in a better position because they owed only $70,000. Hopefully, you are following my argument here… creative investing means you must invest in incredible deals, or it’s simply not worth doing

- When investing creatively, you must be extremely conservative. I’m not talking politics here; I’m talking about planning for the future. This means assuming the worst when buying property. Take as a given that taxes will go up, your unit will sit vacant for a certain percentage of each year (higher than the average for your area), repairs will be numerous and expensive, and you will need to evict deadbeat tenants. Plan for these costs and only buy property that proves to still be a good deal even after a conservative estimate

- Creative finance requires sacrifice. Remember my definition of creative finance: the ability to trade cash for creativity. Notice there is a trade-off involved—one you need to accept. Most of the methods I’ve used to acquire real estate, I didn’t learn from a book. Instead, I discovered the methods at 4:00 a.m. after an eight-hour brainstorming session with my wife, my pen, and my paper, desperately trying to figure out the missing puzzle piece that would enable me to close a deal. This is often the trade. It requires jumping through a lot of mental hoops, numerous conversations with others, and the ability to ask for help. Creative real estate investing is a puzzle that takes real mental (and sometimes physical) effort to put together. If you want easy, then stick with a job, a sizable down payment, and average returns. There is nothing wrong with that, and I’d have chosen the same if I’d had enough money and income when I started. But I didn’t, so I chose creativity. I chose to sacrifice. Will you?

- Creative finance does not mean investing without a cushion. A wise man and mentor once told me, “You can go broke buying good deals.” Even though you need to get killer good deals if you are going to invest with no or little money down, you still need to understand that bad stuff happens. Murphy will show up on your doorstep and start knocking. He might even move his whole family in. Therefore, maintaining a financial cushion to deal with problems is imperative. You don’t need $50,000 in the bank to buy a small rental house, but you do need to be able to weather the storms that will come, relative to the size of the property you are buying and that property’s risk for loss.For example, if you needed to evict a tenant, could you handle several months of lost rent, more than $2,000 in eviction costs, and several thousands of dollars to repair the property? What if you had to do this twice in the same year? These are important questions you must be able to answer, or at least discuss. These questions do have answers, so hang in there and keep your brain turning.I can’t tell you exactly how much money you’ll need to save, because that depends largely on a number of factors, including the following:

- The strength of your target real estate marketYour ability to manage effectively

- Your ability and desire to repair things yourself, if needed

- How difficult and lengthy evictions are in your state.

- How good your credit is.

- How much cash flow you can get

- The average purchase price of your target properties

- The niche you enter

- The strategy you use

- And a whole lot more

-

The point is, be conservative, buy great deals, and have a financial backup plan. If this means spending six months working a second job to save up $5,000 to put into a savings account, then start that second job tomorrow. Maybe it means asking your boss for a raise or lowering your living expenses (remember… sacrifice!). Whatever you need to do, get started as soon as possible. Stop wasting time on excuses and start planning for how you are going to get there

-

what would you do if you were stripped of all of your assets and only have $100 to start over?

- spend the money on dozen of doughnuts, then go to a Goodwill store and buy a bike.

- then I would bike over to a title company or closing attorney and ask for a free list of pre-foreclosure homes. I’d use the last bit of money for a burner phone and then get to work knocking on doors, collecting leads, and making calls.

- I would knock on at least 20 doors a day. After about a hundred doors, I would get a contract. Once I found out the seller’s situation. I could do wholesale, creative finance, subject-to, or lease option.

-

In the US: Homeowners can purchase a home with a mortgage that requires as little as 0% down.

- Homeowners get lower, fixed interest rates.

- Homeowners can qualify with lower credit scores.

- Homeowners are often given the first option to buy foreclosures (especially HUD homes, which are properties that have been foreclosed upon by the U.S. Department of Housing and Urban Development).

- Homeowners can often negotiate better deals with sellers. You can consider a single-family home an investment if you purchase it with the intention of using it as a real estate investment in the future or if you can build substantial equity by doing some light rehab and then parlay that equity into greater investments later

owner occupied investment properties

-

The small multifamily house hack entails adding a unit to a single-family home, which is legal in most locations. The added unit can be used for either vacation or rental purposes.

-

House hacking is a great way to get started in multifamily investing, especially for those who don’t have a lot of capital to put down. Because of the low down payment, you can get a loan for up to 97 percent of a property’s appraised value.

-

House hacking works in any market, and with a duplex, triplex, or fourplex, you’re giving yourself landlord training wheels.

-

House hacking helps you build the systems, skills, and confidence needed to build a generational fortune by renting out houses.

-

To start, you’ll need to determine your maximum purchase price and your expected cash flow. You’ll need to make some adjustments to those numbers once you move out and the property is yours alone.

-

After analyzing the deal, you’ll be able to run the numbers and compare them to a traditional multifamily investment. You’ll need to include property management fees and increase your repair budget if necessary, but the final cash flow and cash-on-cash return should still meet your requirements.

-

House hacking is the first and most important step towards becoming financially free. It entails modifying a property to make it suitable for rental. This entails installing new plumbing, wiring, and amenities like closets and pantries.

-

One of the downfalls of house hacking is that it limits the number of times you can do it. Because you are limited to only one FHA loan at a time, you’ll need to refinance your properties as soon as you obtain more cash, which takes time.

-

If you have a partner, try to change their mindset about real estate investment by sharing your vision and emotions, and by watching media that motivates you both.

-

It is a serious crime to lie on your mortgage application. If caught, you could end up in jail with Beatrice and Bruno, the names of the two inmates who share a cell.

-

Treating your tenant-neighbors like friends instead of business partners is a big no-no. Make them follow the same processes and systems as any other tenant, and this will help you maintain a professional relationship with them.

-

The first steps in house hacking are the same as for any other kind of multifamily investment: educate yourself about what you want, establish your cash-flow capacity, and find a lender to give you a loan.

-

The author advises to look at the numbers twice: first, assuming you’ll be living in one of the units and collecting no rent, and second, after you’ve moved out, to see if they still make financial sense.

-

You can consider a single-family home as an investment if you purchase it with the intention of using it as a real estate investment in the future or if you can build substantial equity by doing something like rehab and then parlay that equity into greater investments later.

-

owner-occupied investment property can be one of the cheapest ways to get started investing in real estate, as you won’t need to spend money on advertising or marketing the property.

-

Many people treat their homes as if they were investments, when in reality, they are massive liabilities that deplete your finances. You can consider a single-family home as an investment if you purchase it with the intention of using it as a real estate investment in the future or if you can build substantial equity by doing some light rehab and then parlay that equity into greater investments later.

-

small multifamily properties, such as duplexes, triplexes, and fourplexes, are eligible for the same American benefits as single-family homes. That is, they are low cost, easy to obtain financing for, and offer the potential to generate a constant monthly income.

-

The decision as to which type of property to buy comes down to your lifestyle: whether you have a large family or not. If you do, you may want to go for a multifamily property.

-

There are low money down lending opportunities that exist for homeowners that simply do not exist for the typical real estate investor. By taking advantage of these opportunities, you can start building your rental portfolio with very little out-of-pocket cash and get started sooner than you may have imagined.

-

The Federal Housing Administration (FHA) is a federal agency created in 1934 to help with the shortage of housing following the Great Depression. The FHA provides low interest loans to qualified buyers.

-

The FHA loan is a government-backed loan that allows you to purchase property. However, it also has its share of problems, such as the Mortgage Insurance Premium that can really add up and the fact that you can have only one FHA loan at a time.

-

The FHA loan is another government insured loan that allows the borrower to borrow money to buy a home. The 203k loan is a subset of the FHA program and allows the borrower to borrow money to pay for cosmetic repairs such as paint and carpet.

-

The biggest difference between a regular 203k loan and a streamlined one is the extent of the rehab. The streamlined one can be used for smaller cosmetic problems, like painting, carpet, and smells, whereas the regular one can be used for structural changes, like moving walls or building additions.

-

The biggest disadvantage of the 203k loan is that it entails even more red tape than the regular FHA loan, and rehabs are riskier since they are subject to the MIP.

-

The 203k loan is a great tool for first-time investors who purchase fixer-upper houses. The key is to use it correctly, which requires finding a property with basic cosmetic issues that can be acquired for far below value and with the potential for quick appreciation after purchase.

-

The U. S. Department of Veterans Affairs (VA) provides financing for veterans and their families. Like the Federal Housing Administration, the VA offers insured loans that protect a portion of the lender’s investment in case of default.

-

The U. S. Department of Agriculture (USDA) offers one that works very similarly to the FHA and VA loan programs. The USDA Rural Development Single Family Housing Guaranteed Loan Program is commonly referred to as the USDA loan.

-

In canada, CMHC is equivalent to FHA loan

BRRRR

-

After graduating from law school, the author attempted to be a house flipper, but was unsuccessful because the market had crashed. He then tried to find a way to pay off his high-interest credit cards by renting out his property.

-

The BRRRR method involves buying a house with short-term money, renovating it, renting it, refinancing it, and repeating the process until you have a large portfolio of cash-flowing properties.

-

The BRRRR method relies on one fundamental principle: increasing the value of a property through renovation. You need to save as much as possible while keeping your costs as low as possible in order to increase the value of your property.

-

To calculate the maximum amount a property could possibly be worth when it’s renovated, start by figuring out what the property is worth when it’s not renovated. This is called the after-repair-value. After the property has been renovated, its ARV will be significantly higher.

-

After getting a feel for the area, the next step is to get the asking price of the house. If it falls with- in your price range, you can start negotiating with the seller.

-

ARV x LTV from Lender = Total All-in Costs

-

[Total All-in costs] - [refinance closing costs] - [rehab costs] - [initial closing costs] = [Maximum Purchase Price, MaPP]

-

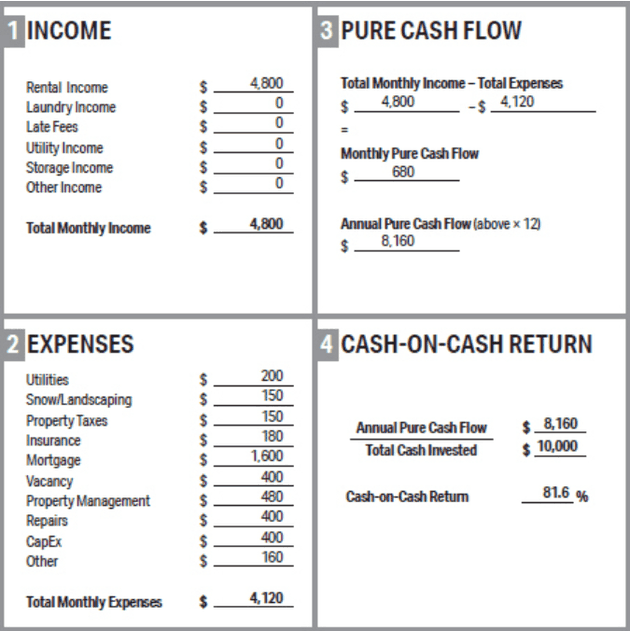

The Four-Square Method allows you to quickly calculate the pure cash flow and cash-on-cash return of a property, after taking into account the purchase price, rehab costs, and the amount of money you put in, as well as the amount you get out.

- you will need to analyze for pure cash flow in 3 different ways to accommodate the 3 distinct phases of BRRRR investment:

- rehab: during this phase, you may have tenants in some of the units, or maybe all of the units were cleared and you’re 100% vacant. During this time, you’ll want to know how much cash flow you’re earning, or losing, each month.

- post-rehab/pre-refinance: when you’ve rented the property out but are still using the short-term money. This period of time, known as the seasoning period, should last twelve months at most, so don’t panic if the returns don’t look promising right away: They are just temporary! But it’s still good to know what you can expect during this period and make sure you’re prepared.

- post-refinance: how is this property going to performance in the long run (after the refianace into long-term money). Specially, we pay close attention to CoC return, pure cash flow, and annualized total return for each year following the rehab.

-

- you will need to analyze for pure cash flow in 3 different ways to accommodate the 3 distinct phases of BRRRR investment:

-

By refinancing a property and pulling out most of the money, you generate an infinite return on your investment because you’re making cash flow while having little to nothing invested in the deal.

-

The other advantage of the BRRRR approach is that it allows you to build a portfolio using low or no down payments. This allows you to acquire more properties and ultimately refinance them for a higher ARV, which allows you to recuperate the money you invested in them.

-

The traditional investment involves putting down a large down payment, while the BRRRR investment does not. The traditional investment has a total loan amount of $240,000, while the BRRRR investment has a total loan amount of $240,000. Both have the same final amount, because all variables are equal, but the BRRRR investment has greater equity since it utilizes the property’s ARV to calculate the loan.

-

Replacing the appliances and the water heater when you refinance a property is a good way to increase your cash flow. Replacing the flooring when you replace the appliances and the water heater is a great way to reduce your time spent on maintenance, which in turn allows you to spend more time on the important tasks at hand.

-

Equity is the difference between what your property is worth and what you currently owe on it. The more equity you have, the wealthier you appear on paper. With each property you buy, your net worth increases by leaps and bounds.

-

The BRRRR method is effective at all different scales, from single-family houses to large apartment complexes. It can also work with self-storage, senior housing, and low-income housing.

-

Because BRRRR is riskier than other types of investing, you must be well prepared for the process. You’ll need to learn how to buy, rehab, and manage rental properties, and you’ll need to be able to refinance and get your money back.

- Lenders can give you pre-approved loans before you start a BRRRR, so you can be certain that you will be able to refinance the house after you finish it.

- To stay on budget, follow these four steps:

-

- Fully understand the work required to achieve the final result and create a detailed scope of work that covers everything,

-

- always include a whoops/overages line item in your budget,

-

- get quality contractors to do the work, or do it yourself, and

-

- hold your contractor accountable for the quality of work.

-

- The after-repair-value, or ARV, is the most important metric when doing a BRRRR investment. The refinance amount is based on the ARV, and most banks will lend between 70 and 80 percent of the new value. If the appraisal on your BRRRR comes in low, your new loan will be low.

- base ARV estimate on good data (talk to a local real estate agent for comps)

- consider challenging the appraisal for refinance if it is low. Provide the appraisal proofs on the rehab works (before after pictures), list all of the rehab works for the appraiser

- Before refinancing a property, make sure to talk with several lenders to determine their seasoning requirements, and be prepared to account for the time between when you buy and refinance a property.

- when you BRRRR a small multifamily property, traditional residential lenders typically require a period of time between when you buy the property and when you refinance it. This period of time is known as seasoning and can affect your math, so it’s important to understand how seasoning works and factor it into your plans. Seasoning is typically six months long but can be as long as twelve months for some lenders. This means you may have to continue paying the higher rates on whatever short-term financing you used for the first six to twelve months, which can affect cash flow in the first year.

-

The BRRRR method entails buying a property with short-term money, rehabbing it, and renting it. Repeat the process as you build your portfolio.

-

Every real estate investor is striving to increase the amount of money they make. The key to achieving this is to find ways to increase the property’s income, lower its expenses, or both.

-

The potential for adding value to a multifamily property is through any changes that will either increase the revenue a property is generating or decrease the expenses it is incurring.

-

Increasing the property’s NOI by $100,000 results in a $2 million increase in value. This can be accomplished by adding value through renovations, creating a more desirable environment for tenants, or increasing the property’s rent.

-

The most effective way to increase the value of a multifamily property is to reposition it and up- grade the units. This requires more work and risk than some of the simpler methods discussed in the book, but it can also provide exceptional returns.

-

Repositioning a property entails making improvements that tenants are willing to pay for. The first step is to understand the market dynamics in the area where the property is located. After that, obtain as many comparable properties as possible, study their pricing details, and make necessary adjustments.

-

Identifying ways to improve the appearance of a property is an important step in positioning it to obtain the best rents. The most effective way to achieve this is by means of repairs and replacements that are easy on the eyes, such as fresh paint and landscaping.

- a good property management firm should be able to help with an initial assessment. Special attention should be given to all major components, such as roofs, windows, doors, sewer lines, roads, and parking areas.

-

Landscaping, painting, and cleaning are some of the first things that need to be done when a property is taken care of, as they have a significant impact on the appearance of a property. Landscaping should be done to add value to a property, not to make it look good.

-

When relocating a property, make sure the parking, roads, and sidewalks are in good shape. If not, make the necessary repairs. This will help with tenant retention when rents rise.

-

The front door is extremely important in establishing the right first impression. It sets the tone for the rest of the house. If a prospective tenant sees a door with a broken handle, peeling paint, and a door that doesn’t lock, they’ll probably think the house is unsafe.

-

Having cameras at the entrance and strategically placed around the office creates a safe and secure impression to tenants.

-

The lobby of a building is like the lobby of a car dealership: it is where you display the lifestyle the customer can have if they purchase the car.

-

Finishes such as paint, flooring, and furniture can add a lot of value to a property. Investing in these upgrades is a good way to improve the appearance of a property and make it stand out from the competition.

-

Unit upgrades should be approached with caution, since they can be very expensive. The best way to handle them is to identify what upgrades are needed for a specific property, how much they will cost, and whether they are worth it based on the income they generate.

-

A well-planned model unit is a crucial part of any upgrade plan. The model unit should have all the upgrade finishes that are included in your upgrade template, and should be meticulously designed and furnished.

-

When repositioning a property, the first thing to consider is what baseline amenities are necessary to meet tenant expectations. After that, focus on adding specific, targeted amenities that meet your tenants’ needs.

- playground/play area, library, pet-washing station, gym/fitness area, walking/running path, community room or clubhouse, outdoor kitchen or grilling area, garages, security fence and gated access, bike racks/storagbe, mail room with package lockers, recycling center, game room, dog park, pool, video intercom, community wi-fi, private, covered parking, doorman or security guard, online portal for payments & work orders, electric car charing stations, valet trash service.

-

Creating a sense of community among the tenants can also help improve the desirability of a property.

-

Renaming a property can help improve its reputation, and getting positive reviews online can help with that as well.

- put up promotional signs and advertise the property as “under new ownership” and “newly renovated”

- offer referral bonuses to tenants to encourage them to talk about all the improvements

- chronicle the property’s transformation on social media with plenty of videos and before-and-after photos

- host a series of open houses. You can also invite community leaders and press for private tour.

- the best time to get reviews are at move-in and after a successfully completed work order

-

The best way to add value to a property is to increase its rent by implementing a good strategy such as increasing the number of units or improving the quality of the units.

-

The author was able to close on the property, but was informed that a couple of the contractors were going to place liens on the building. The attorney that handled the transaction explained to him that this was a result of the seller not being able to pay the contractors.

partnerships

-

the author needed to find a way to buy a triplex which was cash-flow positive despite not having the money to fund the down payment. He came up with the brilliant idea of partnering with a wealthy friend who was willing to front him the money to buy the property.

-

A partnership is a special type of business structure that allows individuals to pool their money and resources together to buy a property. In a partnership, each partner contributes an agreed-upon percentage of the profits, and each partner is legally liable for the debts of the other partners.

-

The Deal Delta is a concept introduced by Br. Jason Hartman in his book How to Invest in Real Estate: The Ultimate Beginner’s Guide to Getting Started. It requires three things to work: knowledge, hustle, and money. You only need two of the three to start a real estate investment. The third, money, you must acquire by partnering with someone who has it.

-

The key to finding partners is to start networking now, even if you don’t have a deal yet. You never know who might have $100,000 lying around just waiting for an opportunity like yours.

-

When trying to find people to invest with, focus on demonstrating the four K’s: knowledge, integrity, tactics, and experience. The most important one is knowledge, since you need to be able to explain how you plan to make money.

-

If you must begin raising money from partners, start with people who don’t care as much about your real estate investing experience since they know your character from other parts of your life. You can borrow someone’s expertise by hiring a more experienced investor, or you can demonstrate your own abilities by creating a PowerPoint presentation or an investor packet that outlines your qualifications and the specifics of the deal.

-

Money partnerships can be either equity or debt, depending on the preferences of the partners. Always check with your partners to discover what kind of partnership they prefer.

-

it will be hard to find a partner unless you can demonstrate you can fly a KITE: the knowledge to pull off the deal, the Integrity to uphold your side of partnership, the Tactics to make the deal work, and the experience needed to justify their risk.

-

investing in real estate with partners to avoid large amount of money upfront

-

Your brand consists of yourself and your product. They are two sides of the same coin, and you need both to develop your real estate brand.

-

Your personal brand is built through three primary areas: reputation, knowledge, and experience. People can smell that guy coming from a mile away. Never pretend to know more than you do, but use your gaps in knowledge as motivation to grow.

-

Your BRRRR approach requires you to develop a strong and consistent product, which is your service. You need to make sure your service is excellent, and it needs to be worth selling. People need to trust your brand, and they will only do so if the quality and profitability of the product you represent is trustworthy.

-

If you build yourself into a trustworthy brand, the money will follow. When real estate investing becomes your passion, you will find that you can’t help but talk about it. In turn, the people you talk to about it will talk to their friends about you.

-

There are four different ways you can work with a Bob, and all of them involve giving up a portion of your profit to the investor, but obtaining a greater share in return. The first is an equity partnership, the second is a down payment equity partnership, the third is a private lending partnership, and the fourth is a credit partnership.

-

Before partnering with someone, you must speak with a CPA and a lawyer who specializes in this kind of thing. Even something as simple as having your partner put in money at the wrong step can cost you thousands of dollars in taxes.

-

While partnerships can be beneficial when it comes to growing your business, they also have their disadvantages. The main reason why partnerships fail is because of personality conflicts. In addition, differences in opinion and suspicion/trust issues can cause problems as well.

-

When you rely on someone else, setting expectations as to how something should be done is easy. However, when your partner doesn’t live up to your expectations, it’s easy to grow bitter and blame him or her. One thing you can do to curtail this is to consistently underpromise and overdeliver.

-

When you are the sole proprietor of a business, taxes and accounting are much simpler than when you have partners. The more partners you have, however, the more complicated the bookwork becomes and the more time-consuming and costly tax season becomes.

home equity loans/lines of credit

-

A home equity line of credit, or HELOC, is similar to a home equity loan, but even though you are allowed to borrow a predetermined amount of money, that money is not necessarily dispersed at the start of the loan. It’s available for you to borrow and pay back with flexibility.

-

Home equity loans are a great way to get extra money when you need it the most.

- They generally have low interest rates, which is generally tied to the prime rate, but the interest rates are adjustable and high during inflation period

- another risk you take is if your house’s value decreases.

-

A home equity loan or line of credit requires that you have equity in your home. The difference between what you owe on your home and its fair market value is known as equity. Lenders calculate this figure as a percentage known as loan to value.

-

The best LTV for a home equity loan is generally around 75%. Anything higher than that is usually considered a HELOC, which stands for home equity loan. With a home equity line of credit, the interest rate is generally tied to the Prime Rate.

-

Another strategy for using your home’s equity to invest in real estate is by refinancing the loan through the bank after the repairs are made and the seasoning period is over. This allows you to pay off the home equity loan, which frees up your residence home equity to be reinvested.

-

The second option is to get a business line of credit from a commercial bank or a portfolio lender. This allows you to access the equity in your properties, which is substantial in some cases.

-

Overleveraging can be dangerous because it restricts your choices. If you don’t plan on selling, and you have a fixed rate mortgage, being underwater may not be a big deal to you, because your payment won’t change. However, overleveraging does remove options, and having options is critical to success in real estate.

-

By using your home’s equity to fund your real estate purchase, you’re reducing the amount of cash flow you receive. Getting a good deal on the property is even more crucial to make up for this reduction.

-

The third danger of home equity loans and lines of credit is their potential for an adjustable rate. This is when you must conduct a Worst Case Scenario Analysis.

-

Equity is the difference between what you owe on your property and what it could sell for. For example, if you owe $50,000 on your home and it is worth $150,000, you have approximately $100,000 in equity. A home equity loan is a loan you can take out from a lender that is secured by the equity in your home. In other words, if you don’t pay the loan back, the lender can take your personal home and resell it to pay the debt. A home equity loan is also known as a “second mortgage,” because it is generally subservient to your primary mortgage. This means that in the case of a foreclosure, the primary mortgage would get paid off first, followed by the second. Before we get too deep into how to use a home equity loan, let’s talk about the difference between the two types of equity products:1. Home Equity Loan – A home equity loan is a mortgage product wherein all funds are disbursed at the beginning of the loan, with a definitive term length and equal monthly payments. For example, you may take out a $50,000 home equity loan at 3.75% payable for 15 years. The payment would be roughly $363 per month for the entire 15 years, or until you paid the loan off. You might think of a home equity loan as similar to a car loan or a normal home mortgage. These loans can have either a fixed (unchanging) interest rate or one that is variable (subject to change with the economy). 2. Home Equity Line of Credit – A home equity line of credit, or HELOC, is similar to a home equity loan, but even though you are allowed to borrow a predetermined amount of money, that money is not necessarily dispersed at the start of the loan. Instead, it is available for you to borrow and pay back with flexibility. If this is a bit confusing for you, don’t worry. Let me give you a really simple analogy: think of it like a credit card. You can borrow money, up to a certain amount, and pay it back at will, though you are required to make at least a minimum payment each month based on the amount you have used. The minimum payment is often simply just the interest that accrued during that month, but some lines of credit require a higher payment than just the interest. For example, you may have a $50,000 limit on your home equity line of credit, but you only use $20,000 of it. If your interest rate on the line of credit is 10%, your monthly interest payment would be $166.67 ($20,000 x 10% / 12). If you paid only the interest each month, your loan balance would never go down, because you would never be paying back the principal. A HELOC typically has a variable interest rate, though fixed rate versions are available

-

As the name would imply, a home equity loan or line of credit will require you to have equity to qualify. Therefore, let’s take a few minutes to explore what equity is and why it matters. As mentioned earlier, equity is the difference between what you currently owe on your home and the fair market value of that home. For example, if you owe $50,000 on a home whose current value is $80,000, you have approximately $30,000 in equity (not including the costs required to sell the property if you wanted to)

-

Today, lenders have learned from the mistakes of the past, and the days of getting 125% LTV loans and lines of credit are gone. More typically, the highest you’ll probably see is around 90% LTV, but even that may be difficult to find. In other words, if your home is currently worth $100,000, the bank will likely cap the total amount you can borrow across all loans at $90,000. So, if you have a first mortgage with a balance of $70,000, and the lender will allow you to borrow 90% (or $90,000 total), you could potentially obtain a loan or line of credit for a maximum of $20,000.Keep in mind that as with nearly all loans, you will need to meet certain credit and income minimums to obtain the lending, and rates and terms will differ based on your LTV, debt, credit, income, and other factors. You may have a ton of equity in your property, but if you are rocking a 520 credit score, obtaining a home equity loan or line of credit will be nearly impossible. Be sure to shop around to various banks when considering a home equity line of credit. In my small town, rates can vary by as much as 10% between banks. I feel sorry for all those people who are paying 13.5% at X Bank while I’m paying just 3.5% at Y Bank. Don’t be like them. Get out there, make some phone calls, and shop around to get the best rate possible on your home equity loan or line of credit

strategies for using hard money

-

Hard money is financing that is obtained from private individuals or businesses for the purpose of real estate investments. It is typically short-term, high interest, and based on the strength of the deal.

-

Lenders that provide hard money loans are often referred to as hard money lenders. These loans are not insured by the Federal Housing Administration (FHA), which is why they’re referred to as hard money. Lenders that provide these loans may be difficult to locate, but BiggerPockets. com has a directory of hard money lenders for you to contact.

-

Hard money loans are provided by banks and other lending institutions, and they are meant for investors who want to buy property and fix it up, and then sell it at a profit. Hard money loans have low interest rates and no down payments.

-

After the market collapsed in 2008, the author was unable to sell his house. With the help of a hard money lender, he was able to pay off the lender in full and refinanced the home through a conventional bank, obtaining an 80 percent loan to value.

-

The amount of money you will need to cover the purchase price and repairs varies from lender to lender, and the amount you are given to draw after the purchase is made also varies. Lenders want to feel as though they will win no matter what, which is why they give out draws to ensure they are covered in case of a default.

-

If the lender will not fund the entire price, you have a few options: refusing to buy the property, borrowing money from another source, such as a partnership, equity line, or credit cards, or using your creativity to come up with other options.

-

Hard money loans are high risk, high cost loans that provide short term solutions to borrowers that need large amounts of money fast. Because of this, hard money loans are best used as a temporary solution when other conventional loans have dried up.

-

The hard-money-to-refinance strategy involves using hard money to buy a property, renovate it, and then refinance it. However, this may not be possible if you cannot obtain a loan.

raising private money to fund your deals

-

Prerequisites before you start raising money

-

Get educated

- The Real Estate Transaction: Who is involved? Order of operations. Learn the jargon.

- Negotiation: Be creative. Solve problems. Prepare more than the other side.

- Accounting & Finance: Know your numbers. Measure twice, cut once. Learn how to create a ProForma from scratch.

-

Develop a track record

- Get some transactions under your belt. As a realtor, wholesaler, or investor. Become known as a “closer”.

-

Take personal inventory - (time, money, skills, goals, your “why”)

- Self-Awareness: Be honest about what you bring to the table. Partner with people whose skill set is complementary.

-

create a business plan- (strategy, market analysis, team)

- Don’t just analyze a property, analyze the market. What’s the value add plan? What’s the exit plan? Who is on your team? Who is doing what?

- When presenting deals to potential cash providers, under-promise and over-deliver. After closing on a deal, make sure to over-communicate with your cash providers and fellow investors.

-

-

cash source

- Retirement Accounts

- People who used to have a high-paying job with a reputable company that most likely had a 401(k) program-even better if there was a company match. These people can’t work for that company anymore.

- The self-employed, like doctors, attorneys, CPAs, and others who don’t work for a big company but may have their own IRA program in-house Those who have retired from the workforce but worked for a good company in the past

- Real Estate Equity

- People who have lived in their house for more than fifteen years

- Homeowners who purchased between 2009 and 2011

- Anyone with a vacation home

- Businesses that own the buildings they occupy

- Cash

- Those who live well below their means

- High-income W-2 earners

- People who seem to already be investing in passive-income-producing assets

- Recent recipients of an inheritance

- Retirement Accounts

-

where to find cash

-

Tier 1 – Core Group: People who already know, like, and trust you.

- making your master list

- Step No. 1 - Write down the following headers:

- Friends

- Family

- Neighbors/neighborhood (this includes stores and restaurants you always go to) . Coworkers

- College/graduate school alumni Groups and organizations you are member of, such as:

- Business networking organizations

- Volunteer/philanthropic groups

- Religious groups

- Social groups

- Real estate organizations

- Step No. 2 - I want you to think about people in each of these groups who may fit the profile to be a Cash Provider for your business. Who would be a good source of IRA investment capital? Who may own their home free and clear? Who are the big savers in each of these circles? Write down the names of the people you aren’t comfortable approaching right now because as you grow, you can circle back to them.

- Step No. 3 - For each column, write down the person’s name, the suspected source of capital, and any pertinent notes you have on why they would be a good source. Go through all your contacts. Your family, classmates from the past, the owner of the restaurant you like to go to- everyone. You probably know more people than you think you do. You may want to try surfing your social media contacts to jog your memory.

- Step No. 1 - Write down the following headers:

- making your master list

-

Tier 2 – Referrals: Ask each existing cash provider if they can refer two investors that might be interested in becoming a cash provider for you.

-

organize your contacts and create a process for staying in touch consistent with these individuals

-

😨 Conquer Fear of Asking For Money: These people are not investing as a favor to you. This is an opportunity for them.

- You can help them build their wealth while you build your business. In today’s investment world, where the value of a stock can drop 20% because of one tweet, they need you!

-

📰 Create a Newsletter:

- Send a brief update about once per month highlighting case studies, pipeline, new opportunities, and most importantly tips and tricks of the trade. Become a resource.

-

📒 Create a Track Record Document:

- Share the details of past projects.

- Try to have before and after pictures and a summary of the financials for each project.

-

-

Tier 3 – Taking it Public: Social Media, Podcasting, Real Estate Investment Association Meetings, etc.

- The best thing about attending a meetup or a mastermind group is that you meet other investors.

- finding lenders via public records (such as county public records)

- finding lenders online

- do your due diligence before using the lenders from the websites.

- expanding your network

- 🤔 Become a Thought Leader:

- Build a megaphone.

- repost real estate articles to medium, biggerpockets, reddit

- guest spots on real estate related podcast, youtube channels

- Broadcast your thoughts on business, share success stories, and caution investors through lessons learned over time.

- Start your own (or be a guest on a) YouTube channel, podcast, blog.

- You can also try to speak at an event.

- Build a megaphone.

- other outlet to broadcast yourself such as blog, podcast

- speaking opportunities

- crowd funding

- private equity fund and equity brokers

-

syndication

-

One way to get started investing in real estate is through the multifamily rental business, by way of syndication. This involves raising capital by selling equity or debt to passive investors, who contribute cash and entrust you with their money in exchange for a share of the profits and the tax benefits of depreciation.

-

The most common misconception about syndication is that it is overly complicated, requires extensive paperwork, and is best left to legal experts. But in reality, it is not your job to understand every law and regulation, but to put the pieces of the syndication puzzle together.

-

The structure of a syndication is different from that of a limited partnership or corporation. There are two types of partners in a syndication: general partners who organize the deal and oversee the entire process, and limited partners who contribute money to close and execute the plan. In return, they receive a share of the profits and tax benefits associated with the investment property’s depreciation.

-

It is important to distinguish between capital raiseers and issuers. A capital raiser is a person or company that raises capital for a project, while an issuer is the entity that is raising capital.

-

A syndication under Rule 506(b) allows you to raise an unlimited amount of money, provided that you don’t publicize the offering or solicit investors. You must, however, have a reasonable belief that the investor is accredited.

-

The main fees that a general partner in a syndication will charge are the acquisition fee, the finance/refinance fee, the asset management fee, and the disposition fee.

-

-

As an alternative to individual projects, syndicates allow you to raise money for several projects at once. The advantages of a fund are the same as for individual projects, but the fund also diversifies single-asset risk for the LPs.

-

How to turn potential into reality

- Most common cash provider questions:

- How/when am I going to get my money back? - (SDIRA - will be deposited into your SDIRA at end of term, with interest. Reg loan - in bank account with interest. at end of term defined)

- What are the risks? housing crash (we use 75% before ARV rule to value deals). tenant not paying (experienced property manager, share screens that we use to screen tenants and a track record. Also a worst case scenario plan)

- How much of your own money are you putting in?

- What if I need my money back?

- real estate isn’t liquid, define loan terms in the promissory note, when the term is up. alternatively they can have someone else buy their note. Make sure they aren’t investing every last dime they own.

- How does this affect my income taxes? - they will get 1099 from us for the interest on the loan, and a K-1 for a partnership deal. Educate on capital gains, find ways for them to beat taxes.

- Most common cash provider questions:

-

How to structure the private loan deal

- Deciding the terms of the loan:

- Who is lending the money and where is it coming from?

- What’s the deal? -

- How quickly do I need to close?

- How much construction is involves?

- need timeline, want to negotiate a construction draw program with lender to lower interest.

- Construction draw program:

- Basically just a tiered investment based on milestones reached on the project vs just 1 big lump sum in the beginning.

- money should be available on short notice, within a week.

- mitigates risk for the cash provider

- Private loan pitfalls:

- loan origination points and fees for renewal - 1 point = 1% of loan principal. renewal fee is usually .5-1% if you don’t pay back on time.

- monthly payments on fix and flips - eat into cash flow, avoid

- prepayment penalties and guaranteed minimums - fee if you sell or refinance a property before a certain date, always avoid. Guaranteed minimum returns aren’t bad idea to sweeten deal for investors & give them a floor.

- Documents for setting up a private loan:

- Promissory Note - defines interest, maturity date, alt fees, etc. Defines what happens if late repayment, default. Original copy held by cash provider, copy held by deal provider. Collect original copy at the end with the words “paid in full” on it.

- Mortgage security document (deed of trust) - Document creates a lien (investor claim) on the property. Means that property owner cannot resell or refinance property without lenders permission. Lender can begin foreclosure if promissory note loan defaults.

- Personal Guarantee - holds borrower personally liable for loan.

- Deed in lieu of foreclosure - Means that ownership of the property immediately goes to lender if the loan goes into default.

- Deciding the terms of the loan:

-

📊 The Pitch Meeting:

-

Face-to-Face is always best. A Zoom call is a close second. A phone call should be the last resort.

-

Do NOT ask someone for a substantial amount of money through email or text, unless you’re sure the answer is unequivocally going to be, “Yes!”

-

We have two ears and one mouth for a reason. Listen more, talk less. Seek first to understand, then be understood.

-

Let them tell you if they’re more likely to be a debt investor or equity investor. Understand their goals and the “why” behind their investment thesis.

-

Buzzwords for Private Money Lenders: Income & Security.

-

Buzzwords for Equity Investors: Tax Benefits, Alternatives Investments, [Generational] Wealth-Building.

-

Be prepared to answer the following questions:

- When do I get my money back?

- What are the risks?

- How much of your own money are you putting into this deal?

- What if I need my money back sooner?

- How will this affect my income taxes?

- What are the logistics?

-

Be prepared to share the following data:

- Personal / Business Goals

- Why you’re doing this

- Track Record

- Deal Analysis

- You will need to prepare a summary of the investment that you are making. This should include an overview of the property and the market, a summary of financial information, your exit strategy, and the team you are putting together.

- What’s in it For Them?

- When raising capital, the most common question from prospective investors is whether you are investing your own money and how much. You must be prepared to answer this question or else risk losing the deal.

-

-

There are several ways to raise capital other than through an IPO, such as through an RBO, a REIT, a REIT-I, a PIPE, a BRRRR, a VCT, or a C corp. The most appropriate method for you to raise capital depends on your objectives and the availability of suitable investment opportunities.

-

Cash-only deals can be problematic because they require more work from the investor, who may be less willing to invest if they don’t have the money right away.

-

506(c) offerings are restricted to accredited investors, but have several advantages over 506(b)s, such as the ability to advertise or generally solicit the offering publicly, which can help you reach new investors and raise more capital.

-

The Private Placement Memorandum is a comprehensive document that details the risks involved in your deal, as well as provide a wide array of information and disclosures to prospective investors. The PPM should be drafted by a qualified securities attorney to ensure compliance and protect you from liability.

-

Keeping a record of your conversations with potential investors is crucial. There are numerous CRM solutions available to help you with this, such as AppFolio, Investor Management Services, and SyndicationPro.

-

When raising money for a multifamily property, working with a private equity firm can be advantageous. These are the large investors who have the capital to fund the acquisition of large apartment buildings. However, they also have considerable power, and can force you to make changes to your plans if they so choose.

-

If you can’t or don’t want to raise capital yourself, you have four options: start smaller, look for alternative financing methods, partner with someone who is well suited to raise capital, or hire or contract someone who will do so on your behalf.

-

It is crucial to secure sound legal advice both before and throughout the fundraising process, as you are entering a complex regulatory environment.

-

Raising private capital is a delicate balance between being approachable and not being a sell-out. It’s crucial to have a positive relationship with your investors.

-

Private money lenders are accessible if you search for them. Private money lenders are not insured by the government, and can therefore be rather risky, but they can also be very profitable.

-

Networking is the process of building relationships with people to obtain business. You are not a salesman asking for money; you are a businessperson holding an opportunity.

-

Networking is a crucial element in any real estate investor’s arsenal, and it can open up doors to many new clients and opportunities.

-

Explain to the lender that these are investments, not sure bets, and that there is risk involved with any investment. However, as long as the lender gets their money back plus interest, they will make money. Furthermore, they will have a lien on the property that gives them full legal rights to seize the property if you break the agreement.

-

Getting a private lender to agree to work with you on a deal is hard, since they are usually extremely conservative and only want to work with people they can trust. Once they commit, have them sign an agreement in writing.

-

Private money lenders, also known as bank lenders or institutional lenders, provide loans to individuals or companies that would not qualify for a conventional bank loan. Lenders provide loans from $25,000 to millions of dollars, and charge interest rates between 10% and 25%.

-

Private money is used in three different ways: borrowed in the form of a private money loan, pooled in the form of a blind pool, and invested in the form of a one-off.

-

The author likes to use a limited partnership to raise money for real estate investment because it is flexible and easy to manage. The investor is the owner of the company, and the manager is the general partner.

-

Having a full-time employee to recruit investors is a great strategy, but be prepared to offer different funds with richer profit shares to attract more investors. Some investors don’t care about the return, they just want a larger share.

-

Private investors are a great source of capital for a rehabber as they are willing to invest their money in a project with the expectation of getting it back after a year with a 10 to 15 percent return. They are also willing to loan money to other investors, which helps expand the pool of money available for purchase.

-

Although using private money is a good approach to buy property, it has its risks, and it is not suitable for everyone. It requires a great deal of networking and dealing with personalities, and the rates may be higher than those you would get with a conventional bank.

lease options

-

A lease option is a legal agreement between a property owner and a tenant that stipulates that the tenant has the exclusive right to purchase the property at a specified date. The tenant does not have to buy the property, but they cannot sell it to anyone else during the specified period.

-

A lease option is a type of real estate investment that involves the purchase of a property with the intent of renting it out. The investor leases the property from the owner, who grants them the exclusive right to buy the property at a predetermined price within a certain period of time.

-

A lease option is a type of real estate investment that involves buying the option to buy a piece of real estate for a set period of time. The investor decides how long they want the option to last, and once that time is up, they either buy the property or let it go.

-

The lease option is a way for the investor to offer tenants the chance to purchase the property after a set period of time for a specified price. The investor acts as the lessor, and collects the option fee from the buyer.

-

Lease option is similar to the traditional option in which the investor leases the property from the owner and then rents it out. However, in this case, the investor leases the property from the wholesaler instead of the owner, and then sells the lease to the property owner.

-

The lease option sandwich is a type of investment strategy that involves two separate transactions on both sides of the deal. The first is the lease option, which is when the investor purchases a property from the current owner and leases it out. The second is the purchase of the house from the renter, which is completed after five years.

-

The more time you have on your contract, the more options you have. It is also important to let the owner know what you’re doing so that no one is surprised.

-

Treat your lease option agreements as a chance to create a win-win-win scenario and help others get what they want as well. Use your power for good, not evil. This means only entering a lease option with tenants who could very reasonably obtain a loan within several years, without charging an exorbitant option fee.

-

The fourth strategy is known as a master lease option. It works similarly to a lease option in that there’s a lease, a lessor, a lessee, and an option fee. However, with an MLO (master lease option), the lessee generally pays all the expenses associated with the property, including taxes, insurance, and any maintenance concerns - and then sublets the property out to tenants who then live in the property

-

Another problem that could arise is major repairs being required after the tenant has moved out, which the landlord is responsible for. This is something to keep in mind.

- one suggestion is to pay for a home warranty on the property (or have the tenants pay for one) at the start of the lease option, one that covers all major maintenance problems on the home.

-

be careful with lease option acquisition where you don’t have control when the owner take back the property and you have no control on it.

- the depreciation can’t be leveraged on lease option acquisition.

seller financing

-

The term seller financed refers to a property where the seller provides the financing. This can be done through a bank, a private lender, or even the seller themselves. The seller obtains a great interest rate on their money, while the buyer does not have to deal with a bank and pays just 5K for the property.

-

Seller financing is another way for you to purchase a home, but it comes with risks such as the due-on-sale clause which gives the bank the right to demand full payment of the loan if the property is sold. This clause makes sense, as otherwise the bank would be liable for any unpaid balances after a sale.

-

There are many benefits to using seller financing, such as the fact that you aren’t required to put down as much money, since the seller is covering the rest. You also avoid having to deal with banks, which can make the difference between a deal and no deal for many people.

- sometimes, the condition of a property may be too poor to allow you to use traditional financing. In these cases, seller financing can give the buyer a chance to own the property, begin fixing it up, and possibly refinance into a more traditional form of financing down the road.

- chances are your seller financed deal will not end up on your credit report. This can make obtaining other loans and mortgages in the future much easier.

-

Some sellers choose to sell via seller financing rather than just getting cashed out because they want monthly income, better ROI, or to avoid paying taxes.

- seller financing can help spread out most of those tax payments over the life of the loan on the seller financed property. the IRS has special tax rules for installment sales, so the seller may need to pay only a small portion of that tax bill each year while the loan is being paid off. Be sure to talk to a CPA for more details on this.

-

The fourth reason to consider seller financing is if you can’t otherwise sell the property. This might be the case if it’s in terrible shape, or if you’re trying to unload a property that is not worth much and without needing to fix it up first.

-

Another creative use of seller financing is to allow the seller to finance just part of the deal, with a traditional lender financing the remainder. This can be done with a second mortgage, but you need to inquire about lender policies before attempting it.

-

You can use seller financing to purchase properties, especially if you are able to get a loan from a lender. This allows you to purchase a property at a lower price than what it’s worth, and then refinance it for what it’s worth plus the amount of the loan.

-

ways to find seller-financed deals

- ask the question “do you need to be 100% cashed out, or are you able to provide any seller financing?”

- look for keywords - when scanning the MLS, Craigslist, and other sources for finding properties, keep an eye out for phrases such as “owner will carry”, “owc”, flexible terms, seller financing, and “motivated” as well as any other indication that the seller is open to a conversation about seller financing

- direct mail - you can purchase lists of homeowners that specify how much equity the homeowner has in their property.

-

risks of seller financing

- due-on-sale clause - only use seller financing when sellers owns the home free and clear (i.e: when sellers has no loans on the property)

- higher interest rates than traditional mortgages from banks

- fewer potential properties - what are percentages of mortgage free homes in Canada and US?

- seller can call balloon payment on the properties. It may be a good opportunity to reduce the balloon the payment (over 30% of the balloon payment) if the seller wants to get the balloon earlier

- For example, follow the scripts: “we don’t have the cash that’s why we setup the deal that way? but in case we could return the balloon payment, how much cash you want to walk away today?”

-

Jerry Norton suggests 2 step process

- first make a low all-cash offer, perhaps 60 percent of the value of the home, to see if the seller is in a position to sell for a discount. Remember the phrases “all-cash” and “close quickly” for this.

- next Jerry would tell you to counter with creative finance. In many cases, the seller will counter back with a higher price, whatever they see on Zillow. Counter back that you are willing to pay more if the seller will accept a creative finance solution. This way, you can find out what is most important to the seller: Do they want less money now or more money later? Generally, this depends on their situation. Did they inherit the house? Is there a divorce underway? Or do they have time to use creative finance, which will earn them more money overall?

realestate wholesaling

-

A wholesaler is the middleman who connects the retailer to the product source, collecting a fee for doing so. A wholesaler is trained to market for those good deals, negotiate the best discount, put together a solid contract, and then sell at a markup to someone else who is not trained or prepared to do this.

-

Yes, you can start wholesaling without any money by simply advertising properties and collecting offers. But to become a successful wholesaler, you’ll need to invest time and money into marketing.

-

The first two strategies consist of driving around an area and mailing to property owners, and the latter consists of using direct mail.

-

The five main ways to find clients are:

-

- networking with other investors,

-

- advertising in local newspapers,

-

- setting up an online profile,

-

- using online marketing tools, and

-

- placing signs in public places.

-

-

knocking down walls that get in the way,

-

- accepting the fact that you won’t be able to get every house,

-

- using the MLS,

-

- leveraging others, and

-

- empowering others.

-

-

before finding wholesale deals, you need to find the buyer first, as the buyer would be able to tell if the deal is a good deal or not.

-

The first step to becoming a successful wholesaler is to find great deals. The old adage of you make your money when you buy is true for the wholesaler. So how do you know what a great deal is. It all comes down to the math.

-

To determine the price you should offer a seller, you need to know what the average ARV of the homes in your area are. To do so, you can use websites and mobile apps that provide that information.

-

The appraised value, or ARV, of a property is determined by comparing it to other similar homes that have recently sold. The appraiser adds or subtracts values based on the differences between the subject property and the comps.

-

The most common method for wholesalers to estimate the property’s ARV is by using square footage. To do this, you need to know the price per square foot for each of the comps. The subject property’s ARV can then be estimated by averaging the price per square foot of the three comps.

-

The first step to finding a good agent is determining if they are honest and reliable. After all, you’ll be spending a lot of time with them, so it is important to feel comfortable with them. You can do this by checking their past sales figures and the prices they got for their clients.

-

The 70% rule states that a property’s ARV should be about 70% of what it will appraise for when it’s ready to be sold. This allows for a certain amount of leeway when negotiating with tenants.

-

Calculate the ARV of a property by multiplying its worth by a percentage. The percentage is determined by using a comparable property as a basis. The more similar the properties, the higher the percentage. After you determine the ARV, you can determine an offer price by subtracting the cost of repairs and your desired wholesaler fee.

-

The second method is known as the Fixed Cost Method. With this method, you take the total costs of the house, such as holding costs, utilities, and closing expenses, and divide them among the number of units you are buying. The resulting number is known as the fixed costs. With this method, you can calculate your maximum allowable offer by subtracting your fixed costs from your appraised value.

-

The Fixed Cost Method involves multiplying the dollar amount of the fixed costs by the number of times the property is expected to be purchased. This allows you to calculate the maximum amount you are willing to spend on a property.

-

The 70% rule of thumb can be a good indicator of value when used in certain markets, but it should only be used as a guideline and not as a hard and fast rule. It’s best to use the fixed cost method to be sure you are making the right offer.

-

Before calculating the cost of rehabbing a property, estimate the amount it will cost to fix each part of the house, such as the living room if it has dog urine odor. Do not forget to include the price of replacing any damaged or stolen items.

-

The final stage of prepping a rehab involves estimating the rehab costs for each category, or room in the house. This involves breaking down the house into its component parts, and figuring out how much each part will cost to replace or repair.

-

When dealing with cash buyers, do your best to estimate the rehab costs and come up with a ballpark figure. Don’t spend countless hours trying to get it exactly right, since you won’t.

-

A wholesaler’s job of finding deals is much more difficult than that of a buy-and-hold investor or a house flipper. A wholesaler is therefore competing not only against retail buyers, but also against every other investor out there, and is at a disadvantage because they need to get the properties for even lower prices.

-

Once you have agreed with the seller on a price, you and the seller should sign the contract. A contract is a legal document that states the terms agreed upon by both parties in the transaction.

-

The earnest money is a deposit paid to the seller to show your good faith to complete the con- tract as promised. It is customary for the amount of the earnest money to be minimal, such as $1,000.

-

After finding a deal, the next step is to secure the contract from the seller. This is done by having the contract reviewed and signed by both parties. The last stage is to get the property into the hands of a cash buyer.

-

A cash buyer is any person or business that can buy your wholesale deal from you without needing to use traditional financing. In other words, they do not need to run to the bank and wait six weeks for a loan to close.

-

Having a cash buyer list is extremely important, but don’t make it your top priority. Focus on wholesaling, and you’ll have no problem finding cash buyers.

-

interviewing all potential cash buyers and asking questions such as:

- how many deals have you purchased in the past six months?

- how quickly can you close?

- are you working with other wholesalers?

- what kind of properties (specifically) are you looking for?

- what kind of LTV are you looking for?

- what kind of property condition will you accept?

-

strategies for finding cash buyers

- BiggerPockets. com is a good place to look for cash buyers. There are more than 200,000 members on BiggerPockets. com, many of whom are looking to buy real estate.

- landlords on craigslist - not all these landlords/property owners will be cash buyers, but most investors with enough knowledge to buy multiple properties could probably also pull off a cash deal.

- real estate clubs

- real estate agents - if you can build a solid relationship with an agent, they can easily supply you with a list of all recent cash sales in any nearby location.

- online lead capture - if you have a website, you can easily setup a “lead capture form” that allows potential cash buyers to submit their name and contact information if they’d like to be added to your buyers list. You can drive traffic to your webpage through social media, online or traditional advertising, your biggerpockets profile, or good old cragslist.

- public record - your local public’s record’s office has information about every sale in your area.

- local title company can provide you a list of properties that have sold without a mortgage lien.

- craigslist ads - a simple subject line that states “wholesale realestate deals at 70% ARV”

- courthouse steps - anyone bidding on a property at the courthouse is a cash buyer. Get to these auctions early and stike up some conversations, hand out business cards, and create some long-lasting business relationships

- hard money lenders - good source of referrals to cash buyers.

- listsource.com - list for potential motivated sellers. Search for properties purchased within a specific period of time and focus on absentee owners who didn’t record a deed of trust.

-

The best way to find a cash buyer is to simply notify everyone you know that you are selling your house, and then wait for offers to roll in.

-

When dealing with a cash buyer, prepare a packet of information that outlines the deal. This includes the address and details, the financial outlook, the condition and repairs needed, and a bid from a contractor. Photos of the property, inside and out. Comparable sales for the neighborhood to justify your assumed ARV.

-

After finding a suitable cash buyer, you must transfer the contract to them. This can be done by providing a non-refundable fee to your buyer.

-

The three most common wholesaling techniques are simultaneous closing, back-to-back closing, and double closing. The first involves closing the deal simultaneously with the buyer and the seller. The second involves closing the deal with the buyer after the seller. The third involves closing the deal with the seller after the buyer.

-

The two techniques involve physically going to another room at the title company (or attorney’s office), and immediately selling the property to a buyer, often within just minutes. The difference between the two techniques lies in the way the deal is funded.

-

A simultaneous closing is when the end buyer uses their cash to fund both the purchase and the sale. In other words, the end buyer’s cash will fund your purchase, and then that same cash will be used to pay you for the property.

-

The back-to-back closing is a method used by wholesalers to purchase a property. The funds are provided by the buyer, who uses them to buy the property and then sells it back to the wholesaler shortly after. The buyer then uses the funds to purchase another property.

-

The closing process involves the title company or attorney who closed the deal issuing a check for you, usually on the day of closing. You are not required to deposit this check into your bank account and can instead use it to continue growing your real estate investment business.

creative combinations

-

search for the pain point

- For example, seller got an unpermitted addition, doesn’t make much money from the home, tired of dealing with tenants after many years.

-

ask question: “What do you need to walk away with?”

-

Jillian found a deal on a fourplex that she can buy for $80,000. The fourplex needs $20,000 in repairs, but Jillian has no money to fund them, so she comes up with a partnership with her family friend Grant. Grant finances the entire $20,000 repair bill and holding costs, while Jillian finances the rehab, takes care of the bills, and manages the property manager for the life of the partnership.

-

Roland acquired a 12-unit apartment complex for $1,000 per month in rent, with a debt-to-income ratio of 25%. After paying the monthly mortgage, he was left with $4,200 in cash flow. He was able to gather $50,000 from the bank by providing a 15% down payment and a 75% loan to value.

-

After saving up a down payment, which for this example is $5,600, the author was able to buy a house that needed some work, fix it up, and sell it for a profit.

-

Furthermore, even though having a large financial cushion to weather storms can help you significantly offset risk, you cannot simply throw money at real estate investments and hope they turn out well. Education is key

-

Screen well! Screening your tenant is one of the most important steps you can take to ensure a positive landlording experience, especially with a lease option sandwich. Although tenant-screening practices are beyond the scope of this book, the most important things you can do are as follows:

- Always run a background check on your tenant. Look for evictions, criminal activities, etc.

- Make sure the tenant/buyer has good enough credit. Their credit score doesn’t need to be 800 for them to qualify, but it needs to be reasonable/improvable for them to be able to get a mortgage to cash you out eventually.

- Look for stability. A tenant who moves every six months without reason is probably not a great candidate.

- Don’t discriminate. Doing so could land you in jail, so know your local and federal discrimination laws and adhere to them.

-

executory contracts

- similar to selling financing except you don’t get the legal title of the property until after you’ve met the terms and paid off the full balance. As you make payments on the land contract, you will have what’s called the equitable title to the property. This keeps the owner from selling the property to someone else or even putting the property on a lien.

- to protect your equitable title, file with your city or county a memorandum of land contract to put the public on notice of your interest in the property.

-

subject-to means the sellers has some pain and sellers finance means the sellers has something to gain

-

subject-to

- sub-to is short for “subject to existing finance”. Rather than buying the property and paying off the existing loan, the investor takes over the existing loan payments that are already in place. The seller can walk from the property knowing the payments are being made, insurance is taken care of, and there are no additional hassles or further responsibilities to consider.

- typical place to look for sub-to is the expired listing

- structure a sub-to deal

- first determine the existing loan terms

- this includes the principal balance, the interest rate, the monthly payment amount, and whether there is a balloon or early due date to pay off the loan. To find out, simply ask the homeowner to provide the most recent mortgage statement or have them get a payoff letter from the lender.

- determine the equity. (previous owner owes - what’s the property worth)

- decide on your exit strategy

- either flip the deal or keep it as long-term rental.